Heksagon High-Risk Call Alerts for Banks

Protect your customers from vishing and impersonation fraud with real-time network intelligence that detects threats invisible to traditional security systems.

Stop Vishing Attacks Before They Reach Your Customers

Vishing and impersonation fraud cost banks billions annually and erode customer trust. Attackers spoof caller IDs to impersonate bank staff, tricking customers into revealing credentials or authorizing fraudulent transactions.

Heksagon’s High-Risk Call Alerts leverage carrier-level visibility to detect and block threats in real time, before fraudsters reach your clients. Built on our Voice Firewall platform, the solution identifies spoofed CLIs, validates caller authenticity, and delivers instant alerts to your security team.

Heksagon High-Risk Call Alerts Key Features

Heksagon's High-Risk Call Alerts deliver network-layer threat intelligence that traditional bank security systems cannot access. The solution monitors all calls terminating to your protected numbers, identifying fraud indicators invisible from the enterprise perspective.

Real-Time CLI Spoofing Detection

- Verifies CLI ownership via regulatory databases

- Validates call origination using carrier protocols

- Detects mismatches between displayed and actual numbers

- Flags international calls spoofing local bank CLIs

- Identifies patterns linked to spoofing campaigns

Comprehensive Threat Intelligence

- Known fraud number blacklists (industry-sourced)

- Geographic anomalies and high-risk origin detection

- Calling pattern analysis for burst activity

- Call validation across networks

- Redirected call detection via suspicious routing

Multi-Channel Alert Delivery

- Real-time API push to SOC/SIEM/FMS

- SMS and email alerts with full context

- Dashboard for live monitoring and investigation

- Call center integration with risk screen pops

Actionable Threat Intelligence

- Severity scoring based on threat indicators

- Spoofed vs. actual origin details

- Targeted customer identifiers

- Fraud type classification (e.g., wire fraud, credential theft)

- Recommended response actions

- Historical data for correlation and investigation

Client Protection Workflows

- Automated client warnings via SMS, app, or outbound calls

- Optional real-time call blocking

- API-triggered account freezes

- Case creation in fraud management systems

- Evidence packaging for law enforcement

Regional and Cross-Border Protection

- Domestic and international call validation

- Multi-carrier fraud detection collaboration

- Threat intelligence sharing with financial partners

- Support for traveling or overseas clients

Compliance and Audit Support

- Full logging of detections and actions

- Audit trails for proactive fraud prevention

- Regulatory compliance reporting

- Evidence collection for prosecution

- Integration with case management systems

Behavioral Analytics Integration

- Customer baseline behavior comparison identifying anomalies

- Device and location verification during high-risk calls

- Transaction pattern analysis detecting social engineering indicators

- Multi-factor authentication triggers for suspicious call scenarios

- Machine learning models continuously improving detection accuracy

How Do Heksagon High-Risk Call Alerts Work?

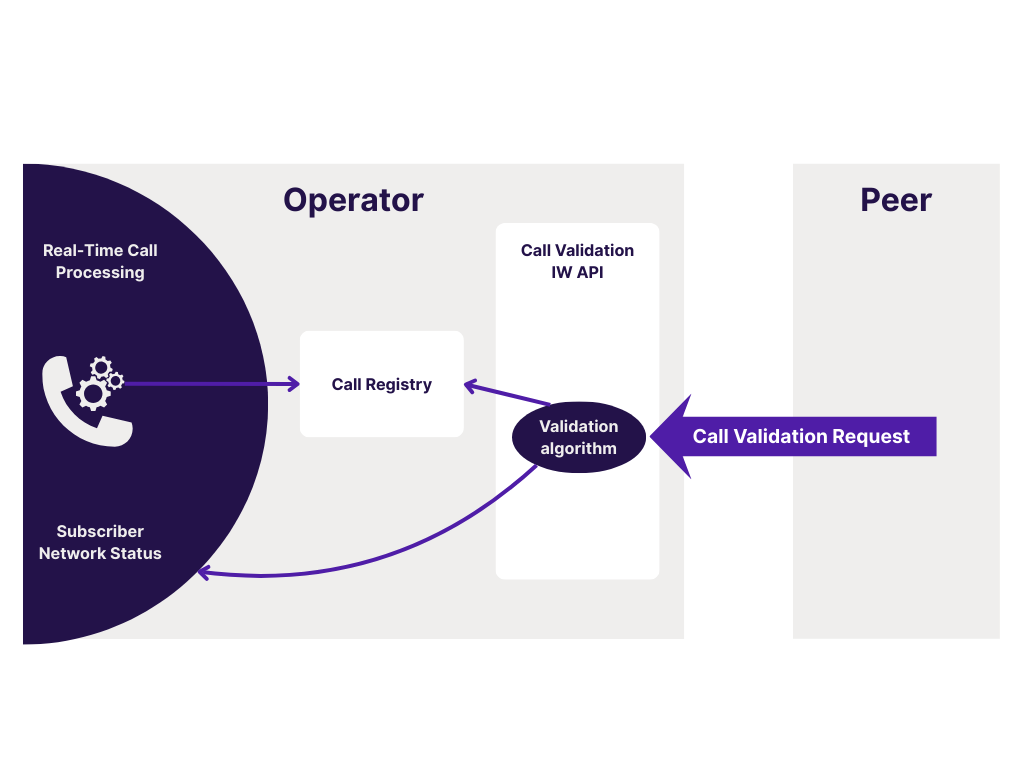

Heksagon High-Risk Call Alerts operate as a network-integrated intelligence layer, deployed within the mobile operator’s core infrastructure. This enables banks to detect fraud indicators in real-time signaling traffic, a visibility traditional enterprise systems lack.

Network-Layer Monitoring

Our platform monitors all incoming calls to protected bank numbers, analyzing:

- Actual call origination points versus displayed caller IDs

- Routing paths revealing intermediary carriers and potential manipulation

- Subscriber status verification confirming caller legitimacy

- Real-time call validation with originating networks

- Geographic and timing patterns indicating fraud operations

As calls arrive targeting your customers, the system processes multiple fraud indicators simultaneously:

Call Setup → CLI Verification → Pattern Analysis → Validation Query → Risk Scoring → Alert Decision

The detection engine evaluates:

- CLI Authenticity: Is the displayed number legitimately assigned and currently in use by this caller?

- Call Validation: Is the call actually active in the claimed originating network?

- Blacklist Status: Does the calling number or route match known fraud patterns?

- Geographic Logic: Does call origin align with expected customer interaction patterns?

- Volume Analysis: Is this part of a bulk fraud campaign targeting multiple customers?

Real-Time Risk Scoring and Alert Generation

Each detected threat receives a risk score based on indicator combination:

- Critical: CLI spoofing of bank numbers, calls from known fraud operations

- High: Blacklisted numbers, suspicious international origins, validation failures

- Medium: Geographic anomalies, unusual calling patterns, redirected calls

- Low: Minor inconsistencies requiring investigation but not immediate action

Alerts include:

- Timestamp, severity, threat type

- CLI and actual origin

- Targeted customer number

- Fraud indicators and recommended actions

Integration Architecture

The system integrates via standard APIs, processing only call setup signaling data, without touching call content or customer-sensitive information.

It supports:

- SS7/SIGTRAN for TDM networks

- SIP for VoIP/IMS environments

- STIR/SHAKEN, SRI-4-SM, and HTTP APIs for validation

- Real-time updates from industry threat databases

Heksagon High-Risk Call Alerts Documentation

-

Heksagon Branded Calling Brief

Need more information on our High-Risk Call Alerts Module? Take a look at our latest materials!

Related Products

Didn't Find What You Were Looking For?

Frequently Asked Questions

What are High-Risk Call Alerts and how do they protect banks?

These are real-time threat notifications delivered to financial institutions when fraudsters attempt to contact bank clients using vishing, impersonation, or CLI spoofing techniques. The system analyzes signaling data to detect threats before customers are affected.

How does this solution detect CLI spoofing that traditional systems miss?

Traditional bank systems only see what arrives at the phone lines. They cannot verify the true call origin or detect when caller ID has been falsified. Our network-layer visibility reveals the actual source behind spoofed displays.The solution operates at the carrier network level, accessing signaling data unavailable to enterprise systems.

What types of fraud does this solution help prevent?

The solution addresses any voice-based fraud technique targeting banks and their customers. High-Risk Call Alerts prevent Vishing, CLI spoofing, account takeover, wire fraud, robocalls, social engineering, and executive impersonation.

How does the solution ensure customer privacy and regulatory compliance?

The system processes only call signaling metadata (calling number, called number, call routing information) without accessing call content or recording conversations. Bank customer data remains within your systems and alerts contain only fraud indicators and threat intelligence, never account balances, transaction details, or sensitive personal information. The system complies with GDPR and telecom security standards.

What results can we expect after deploying High-Risk Call Alerts?

Financial institutions implementing High-Risk Call Alerts typically report: significant reduction in successful vishing attacks, prevention of high-value fraud (wire fraud, account takeover), improved fraud detection efficiency, faster incident response, enhanced customer satisfaction, and competitive differentiation in security-conscious markets.

Let's Get in Touch!

Interested in our enterprise-grade Call Alert service? Fill out the form and our solution experts will contact you in two business days!